The Nvidia (NVDA) money-making train has only just pulled out of the station.

Or so says one veteran tech investor.

“I’m saying like it [Nvidia’s value] could double again between now and the end of the year,” EMJ Capital founder and president Eric Jackson said on podcast.

To put that in perspective, Jackson thinks Nvidia’s market cap could hit $6 trillion by year-end from $3.25 trillion or so currently.

Jackson reasoned the company stands to get there by delivering a very, very strong earnings report in August or November (or both) that shows off continuing demand for H100 and H200 chips while teeing up the potential of its new AI-focused Blackwell chips.

That would align with what Nvidia founder Jensen Huang told Yahoo Finance on demand trends back in late May.

If Nvidia’s earnings reports come in as he expects, Jackson thinks investors will be open to paying a much higher price-to-earnings (PE) multiple to own its stock.

That’s a bold statement, seeing as Nvidia already trades on a forward PE of about 50 times, per Yahoo Finance data, almost two times the broader market multiple.

Added Jackson, “I don’t know if it’s going to be August [earnings], I don’t know if it’s going to be November [earnings], but I think there is going be this euphoric reaction. And if so, the stock goes back to 65x forward earnings and you’re there at like $250 per share.”

Nvidia shares trade at $131 as of this writing, up more than 170% year to date.

To be sure, it has been another year of milestones for Nvidia.

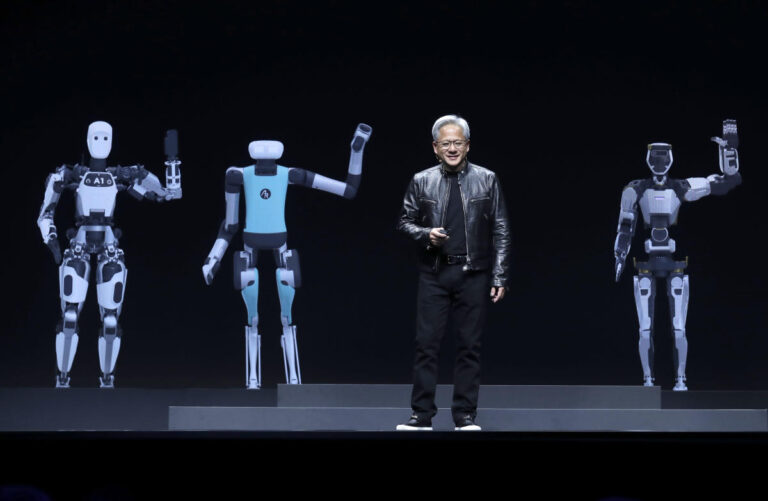

On June 18, its market cap hit a staggering $3.34 trillion, eclipsing Microsoft (MSFT) to become the world’s most valuable company. Before that, Huang took the wraps off his powerful Blackwell chips and proclaimed the company is building AI factories.

Nvidia has since lost the most-valuable-company crown to Apple (AAPL) and Microsoft (second place), but detractors on the Street are few and far between.

“Positive takeaways for Nvidia include: 1) despite the impending launch of Blackwell in the second half of 2024, we are not seeing any signs of a demand pause as demand for H100 remains robust, as we continue to see rush orders; and 2) the interest and demand in GB200 is greater than we initially had sized as the majority of the mix is expected to be NVL72 vs. NVL36,” KeyBanc analyst John Vinh said in a client note this week.

A few non-Nvidia permabulls have started to appear, however.

New Street Research analyst Pierre Ferragu downgraded his rating on Nvidia last week to Neutral, citing valuation concerns.

Ferragu said he sees “limited further upside” based on conversations with contacts in the supply chain. The bull case on Nvidia may not emerge beyond 2025, putting expectations at risk, Ferragu explained.

Meanwhile, Nvidia’s success story is attracting hungry competitors — and that may stand in the way of the chip juggernaut, warned Goldman Sachs asset manager Brook Dane.

“There’s very little likelihood that there isn’t competition out there [for Nvidia],” he said.

© Yahoo Finance