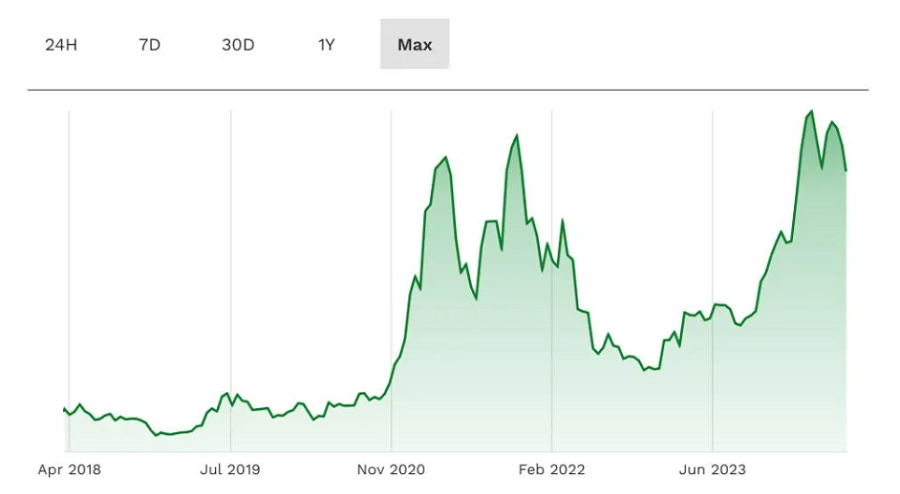

Bitcoin has roared back this year—boosting the price ethereum, XRP and the wider crypto market—though traders are braced for a “terrifying” price crash.

The bitcoin price has recently dropped under $60,000 per bitcoin after topping $70,000 in early June, with one billionaire bitcoin buyer recently revealing a huge reversal.

Now, as a radical policy plan puts bitcoin on a $16 trillion collision course with gold, a U.S. Securities and Exchange Commission (SEC) leak has sparked expectations Wall Street could be about to wade further into the bitcoin and crypto market.

Some companies and financial institutions have agreed terms with the SEC that would allow them to skirt controversial crypto accounting guidance that effectively prevents banks from holding crypto on behalf of clients, an anonymous source told Bloomberg.

The SEC’s staff accounting bulletin 121, known as SAB 121, requires banks and other companies that custody crypto to record their customer’s crypto holdings as liabilities on their balance sheets, making it complicated and costly to do so.

The Wall Street companies have shown the SEC they have the technology and procedures in place that allows customers to get their crypto back as they would with any other asset when there is a bankruptcy, an anonymous source also told The Block.

This week, the Democratic Party-controlled House of Representatives voted to uphold president Joe Biden’s veto of SAB 121.

“SAB 121 is one of the most glaring examples of the regulatory overreach that has defined chair Gary Gensler’s tenure at the [SEC],” House financial services committee chair Patrick McHenry, R-N.C., said in comments reported by Blockworks.

“It limits consumers options to safely custody their digital assets, upending decades of bank custody practices and increasing concentration risk.”

There had hope among the crypto industry that the growing Republican acceptance of bitcoin and crypto could lead the Democratic Party to back down from its broadly anti-crypto stance.

“President Biden vetoed the first digital asset-specific legislation that ever passed the House and the Senate,” McHenry said. “It’s never been clearer; this administration would rather play politics and side with power-hungry bureaucrats over the American people.”

In May, Michael Saylor, the executive chair of software company-turned-bitcoin buyer MicroStrategy, called on lawmakers to ditch SAB 121 after U.S. Senate joined the House of Representatives in seeking to scrap the SEC crypto policy before president Biden vetoed it.

“Wall Street wants bitcoin, the House of Representatives wants bitcoin, and now the Senate wants bitcoin,” Saylor posted to X.