Investors’ excitement over airdrops and other incentives fueled TON Network’s TVL, but how sustainable is this strategy?

Toncoin (TON) is the native coin of The Open Network, a layer-1 blockchain initially developed by the Telegram messaging app. The TON ecosystem is largely driven by Telegram’s 900 million active users.

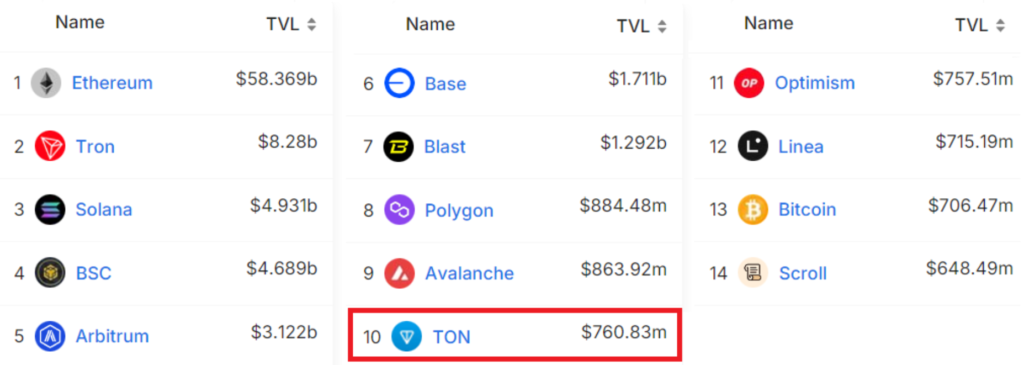

Despite being relatively new to the decentralized applications (DApps) ecosystem, the TON Network has surpassed Optimism to become the tenth largest blockchain in terms of total value locked (TVL).

Upcoming plans include Bitcoin bridge and EVM compatibility

On June 26, Bitget crypto exchange and Singapore-based investment firm Foresight Ventures announced a $20 million TON ecosystem fund to support early-stage projects and TON-based applications. Previously, the exchange had launched an official Telegram signal trading recommendation bot, enabling group owners to integrate this functionality at no cost.

Further contributing to TON’s success is the anticipated launch of the TON applications chain, a layer-2 network on top of the TON blockchain. Announced on July 9 and backed by The Open Platform, this project will utilize Polygon’s technology and offer compatibility with the Ethereum Virtual Machine (EVM), making it easier for developers to port DApps to the new TON layer-2 solution.

The TON Foundation has also partnered with 1inch and Sign to launch a Web3 startup accelerator named Triangle. Announced on July 10, this initiative focuses on play-to-earn mini-games, following the successful launch of the Telegram-based game Notcoin. Additionally, OKX exchange announced on July 17 the integration of the TON network into its standalone Web3 wallet, enabling users to manage and swap assets using Toncoin’s blockchain.

More recently, on July 18, the TON Foundation announced its Teleport Bitcoin bridge, which will allow integration with TON ecosystem DApps, including decentralized exchanges (DEX) and lending platforms. Blockchain bridges facilitate the transfer of tokens or data between different networks. To secure this bridge, the TON Network employs measures such as a trustless architecture and a “simplified payment verification client.”

TON Network’s declining volumes and airdrop frenzy

The TON Network’s most successful decentralized applications (DApps) in terms of total value locked (TVL) are the decentralized exchanges DeDust and Ston Fi, holding $383 million and $301 million in deposits, respectively. Despite their apparent success, a deeper look into the network’s activity reveals that some of its top DApps are struggling to sustain volumes, while user growth has been mostly driven by a handful of airdrops.