On Thursday, a noteworthy event occurred in the cryptocurrency market as $1.3 billion worth of USD Coin (USDC) was transferred from significant whale addresses to the crypto exchange Coinbase. This sizable movement has sparked speculation among market observers, who interpret it as a potential bullish signal for both Bitcoin (BTC) and Ethereum (ETH).

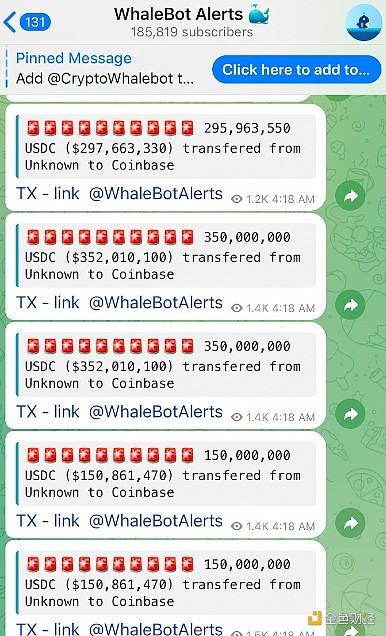

Analyst Lark Davis commented on the significance of this transfer, suggesting that if indeed it represents a large-scale purchase by a whale at current market prices, it could substantially influence the prices of Bitcoin and Ethereum. The transfers, totaling $1.3 billion, occurred in five separate transactions ranging from $150 million to $350 million each, all on April 25 at 08:15 UTC, according to data from Etherscan.

In the cryptocurrency trading realm, large deposits of stablecoins like USDC are often seen as indicators of forthcoming bullish market activity, signaling potential significant buy orders in the near term. Conversely, substantial crypto deposits on exchanges may indicate an impending sell-off, prompting caution among traders.

Nevertheless, analysts caution against placing too much reliance on whale movements as a predictive tool for market behavior. While $1.3 billion represents a substantial capital influx, its impact depends on how and where it is deployed within the market.

There is speculation that whales may not immediately purchase assets but instead place limit orders, creating robust support levels for the cryptocurrencies they are investing in. These limit orders effectively establish buy walls, reinforcing the asset’s price at certain levels.

However, it remains uncertain how these large transfers will ultimately affect the market. Some argue that if a significant portion of these funds were directed towards a single cryptocurrency token, it could positively shift the market by increasing liquidity and potentially elevating the prices of other cryptocurrencies. Nevertheless, there are concerns about overexposure risks associated with such concentrated investments.

Despite this significant movement of funds, the overall sentiment in the crypto market has slightly declined, as indicated by the Fear and Greed Index. The Greed score dropped from 64.04 to a neutral level of 59.78 over the past 24 hours, signaling a potential shift in traders’ focus away from accumulation strategies.