Bitcoin tumbled on Tuesday shortly after it reached a new all-time high for the first time in more than two years.

The price of the cryptocurrency topped $70,210 on Tuesday morning, according to Coin Metrics, and then quickly pulled back. The losses deepened in late afternoon trading. It was last trading lower by 8% at $61,973.37.

However, with bitcoin on a hot streak, up 45% this year already, investors have cautioned that things could soon cool as unrealized profit margins approach extreme levels.

“The market is positioned for a steep correction, possibly between 10% and 20%,” said Ed Tolson, CEO and founder of the crypto hedge fund Kbit. “Any material move down will result in cascading liquidations on the crypto perpetual swap markets, where retail has piled into levered long positions, where funding rates are very high. Over the next few quarters, we expect bitcoin to perform well, but with sharp corrections along the way.”

Bitcoin briefly surprasses its previous record

Oppenheimer’s Owen Lau agreed.

“The rise is so much so fast that we are cautious about a correction,” he said. “But longer term, there are still catalysts supporting the positive price action.”

Bitcoin notched its previous record of $68,982.20 on Nov. 10, 2021, about a year before the catastrophic failure of FTX plagued the crypto industry in what some call crypto’s Lehman Brothers moment.

“Bitcoin reclaiming its all-time high yet again shows it is never going away,” said Alex Thorn, head of research at Galaxy Digital. “In its 15 years of existence, bitcoin has seen four 75% [plus] drawdowns, and each time it has come roaring back.”

Clara Medalie, research director at crypto data provider Kaiko, echoed that sentiment, saying a new record is “an important psychological milestone” and “demonstrates crypto’s remarkable ability to bounce back and continue to persevere despite big headwinds.” However, it “doesn’t have much material impact on the pace of innovation in the industry,” she added.

“Bitcoin becomes more useful as it grows more valuable,” Thorn added. “At higher market caps and daily float, it can support larger allocations. Bitcoin’s volatility has consistently decreased over time, allowing allocations to take larger position sizes.”

Since the beginning of February, investors have been watching key themes in the bitcoin narrative push its price higher.

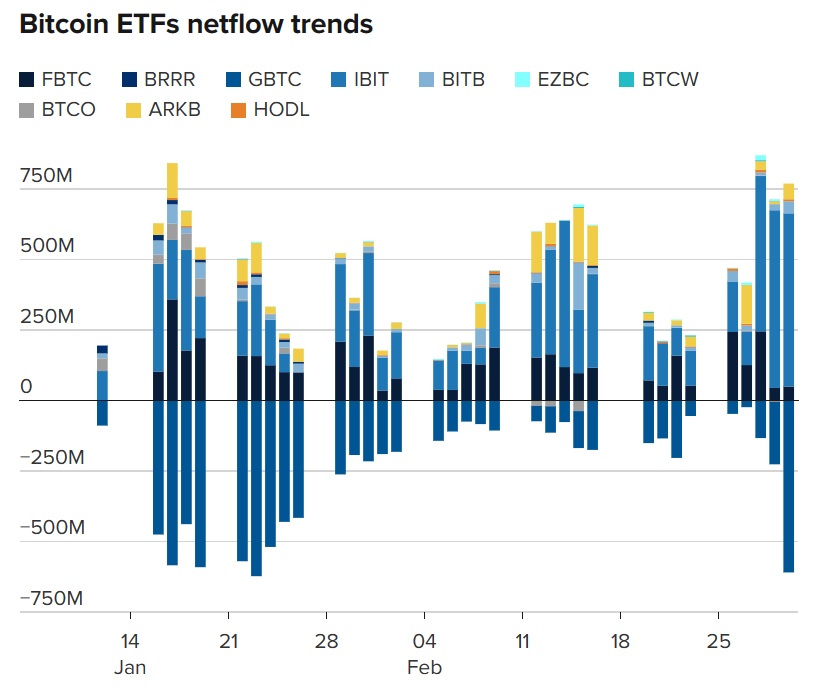

Catalysts driving the surge in the cryptocurrency include the U.S. spot bitcoin ETFs that started trading earlier this year, along with the tightening bitcoin supply ahead of the late April “halving.” This event is designed to create a scarcity event around the asset. The flagship crypto’s upward trend accelerated this week.

Despite Tuesday’s immediate correction, the new record is a triumph for an industry that has long suffered from reputational and regulatory risk that seemed to be at its worst just two years ago, when bankrupt crypto lenders dragged down crypto investors and crypto exchange FTX collapsed. At the end of 2022, as traders were trying to gauge the potential extent of the FTX contagion, bitcoin fell to a two-year low. The cryptocurrency fell 64% that year and has been fighting to prove its legitimacy since.

“The odds have always been against bitcoin,” Thorn said, citing naysayers who have referred to it as “a bubble” and compared it to the “tulip mania” in Holland during the 1600s. “The people show time and time again that they want a decentralized, programmatic, scarce digital currency.”

It also could signal the start of a new wave of retail investors re-engaging with the crypto market, said Needham analyst John Todaro.

“Retail interest is oftentimes momentum driven, and all-time high levels are a pivotal momentum driver for even more investment,” he told CNBC. Additionally, “this could lead to more capital flows, ironically, into altcoins that comparatively start to look cheaper,” he said.

Crypto, led by bitcoin, made a strong recovery in 2023, advancing 157%. The digital asset initially received a boost from the regional banking crisis in the U.S., and it caught a tailwind from speculation at the time that ETFs tracking bitcoin prices would receive approval from the U.S. Securities and Exchange Commission.

Some investors remain skeptical about the young crypto asset class, how to value it or whether it has any intrinsic value. Nevertheless, U.S. spot bitcoin ETFs have brought legitimacy to it and have been hugely popular, with BlackRock’s iShares Bitcoin Trust (IBIT) passing $10 billion in assets under management last week.